For those people who are concerned about increasing property tax rates in the years ahead, there is likely nothing to worry about.

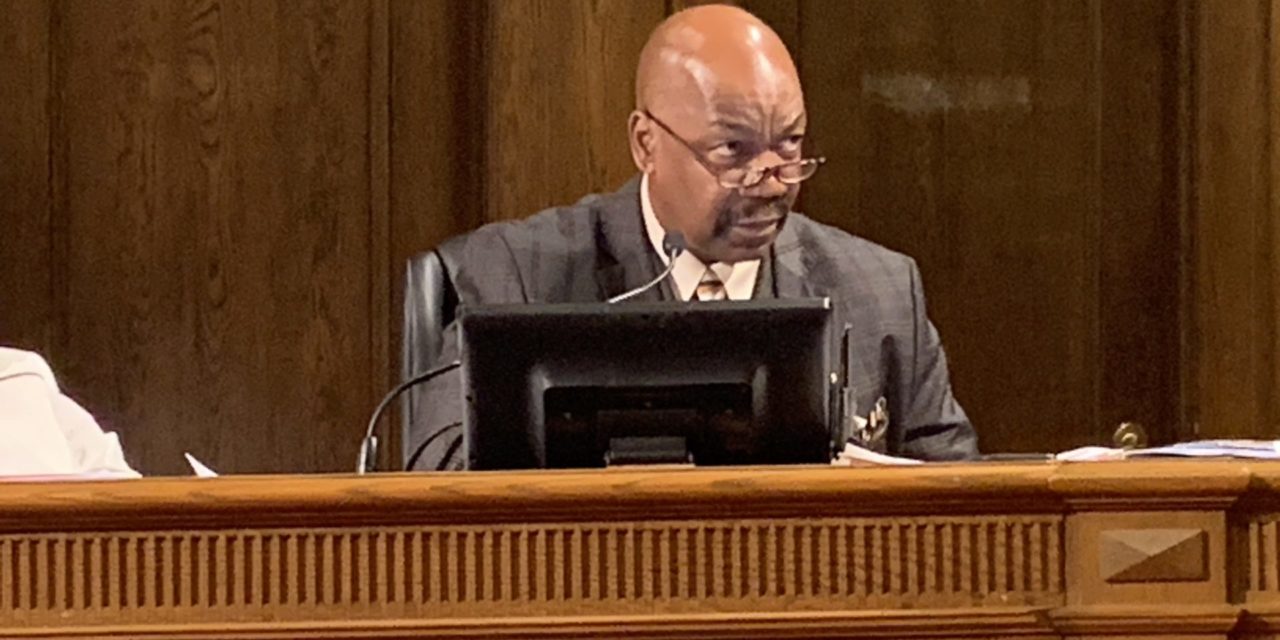

This week, Chairman of the Board of Commissioners Skip Alston pledged that he will not vote for a property tax hike in Guilford County in the next four years.

Alston, who was asked several times if he meant exactly what he was saying, confirmed that he simply will not approve a property tax hike over the coming four years – the time between now and the next countywide revaluation of all property by the Tax Department.

That’s a real reason for property owners to rejoice. It’s true that Alston is only one vote on a nine-member board, but he’s also the de facto leader of the Democratic Party in Guilford County – and the Democratic majority on the Board of Commissioners almost always follows Alston’s lead.

If Alston doesn’t support a tax increase, there’s almost no chance there will be one.

Also, when a Republican majority controlled the Board of Commissioners from 2012 to 2020, the Republicans never raised the tax rate, and, in fact, lowered it slightly over that period. So, if the Republicans win the majority of the board in the coming election, there’s also almost no chance of a property tax increase.

The bottom line: Alston’s pledge this week virtually guarantees that county property owners will not see a tax rate increase in the coming years.

One reason this is possible is that the Board of Commissioners is enacting a large “hidden” property tax increase this year. The 2022 revaluation of all property in the county wlll mean tens of millions more dollars coming from property owners each year – even if the property tax rate is left at the current level for years to come.

When the Republicans were in power during the previous revaluation, they lowered the tax rate to “revenue neutral” status due to the increase in the value of homes businesses and other property in the county. In other words, when property values increased, the Republican board lowered the tax rate to a level that brought in an amount of revenue identical to the amount that would have been brought in without revaluation.

Alston said that the county will have enough money to meet its increased needs without raising the tax rate. He also said that, since the county is planning to move to a four-year cycle for revaluation rather than the current five-year cycle, that change will likely bring in more money at the existing tax rate. So, due to a large increase in property values captured in the new revaluation, Guilford County government will rake in tens of millions more in property taxes even with the tax rate fixed at the current level.

Alston said he doesn’t know what other county commissioners will do in the future, but he will not back a property tax rate increase.

He said that the extra revenue from the 2022 revaluation will meet the needs of the county. He said there are many needs that must be met.

“We need to pay our employees more,” Alston said of the roughly 2,500 people on the county’s payroll. “Social services workers, for instance, due to the caseloads, aren’t being paid enough for the county to retain them.”

Alston also said the county also needs to provide the school system with enough funds in the coming years to pay teachers better and also to pay back the debt on a $1.7 billion school bond referendum he hopes voters will pass in May.

Alston also said it’s important to keep in mind that the other commissioners may think differently about the matter, so, he said, it’s conceivable a majority of the board may approve a tax hike even without his vote at some point down the line.

While our property “tax rate” may not increase, we will all pay more property taxes because the value of our property skyrocketed. If you are concerned, make the adjustments to a revenue neutral basis. With inflation out of control, combined with the extra sales tax and the school bonds, who can afford to eat?

And I am to trust this band of thieves?

Won’t vote for a tax rate increase because they are getting a windfall tax increase due to rising property values. Skip has never been one for honest communication.

How does he figure he’ll be around In 4 years Kinda presumes he’ll be around for 4 more years

Hopefully he is seeing the handwriting on the wall. Vote em out!

Of course he will say that. He’s already fleeced the city and county taxpayers again. He’s smiling all the way to the Chevy dealership to order his new C 8. Can’t wait to see it.

Can we have that signed in blood? And what happens if Skippy’s not there?

For real meaningful change, if it currently sits on a Board or Council – vote it to the curb! Use your vote wisely in 2022.

Why would you need to increase the property tax rate when values went up 20%+ in addition to this extra sales tax Skippy wants to shove down our throats? Skippy, we’re not that stupid.

“We need to pay our employees more”… the perennial cry of the Parasitic Sector.

Yeah, right.

There is no limit to the greed of the “Public Sector”, but when they’re in charge of a universal shakedown of the citizenry, why not vote yourself ever increasing sums of money?

Good news. Thank you for planning ahead. The reevaluation of property is not some tax increase passed secretly by the county commissioners. The reevaluation process reflects the increase in property values, and a four year promise of no property tax increase is looking forward.

No, it’s a pretext for squeezing more money out of the citizens.

They used to do it every 8 years. Now it’s every 5 years. Soon it will be every 4 years – because government greed never stops, it only accelerates.

Oh thank you King Skippy, his royal majesty

The property valuations have increased so much it does not matter if they raise the tax rate. I know Skip thinks we are all stupid.

Keeping the same rate with a greatly increased valuation is definitely a tax increase.

If the tax rate is not lowered, The AMOUNT of increase for many taxpayers is 60-70% more than they paid last year; I calculate my own additional tax on my personal residence at close to $4,000.00 more than 2021. Rejoice at Skippy’s double talk? Celebrate big raises for government workers as we slide toward Biden’s recession and my net income drops? We need a tax revolt if the rate is not adjusted in a more reasonable manner.

This proves that Skippy thinks we’re all stupid. With the large increase of property values, County and Cities will get millions of dollars in additional income. The tax RATE needs to be decreased just as it has been in previous reevaluation years. Talking about NOT increasing the tax rate is just more ‘smoke and mirrors.’

Bend over & grab your ankles. If Skip said this, there’s something much more sinister coming your way.

And to all comments today”Vote Dem Bums Out”!!!!!!I I have said in the past Democrats are for one thing-where can I raise their taxes!!! Please all Guilford County, let’s vote these Dems out of power.

The city of Greensboro is also in need of a giant purge,they are totally one sided with all Dems on their board.If we as one we can pull this off! If not we will be stuck for a long while.

In other parts of the US the Republicans are making big inroads in school boards and other races ,senate and hour.

You people in Greensboro and Guilford county keep voting the Democrats into office so you must be damn happy paying for the numerous rat holes and waste …keep it up!

What a CROCK, you do not have to raise taxes, since you gouged the homeowners with these hellacious re-evaluations

Leviathan. It’s easier to spend other people’s money. And much easier to fool someone, than convince them they’ve been fooled!

Skippy knows what he’s doing. The people that vote for him will lap up the no tax rate increase as many of them don’t own any real property.

My property tax value increased from 174k to 200k. But my taxes went up from previous year 700.00 to Greensboro. …1960.00 to 2691.00.

I hear our rates are higher than Charlotte or Raleigh now. Just don’t get how this can be legal.

That’s roughly 25 % tax increase by dollars with home value increase of 12.5%.

Now Biden is breaking his promise too. When do the People stopped these crooks. Anyway, will be moving the Mountains before next one..$1000.00 a year taxes! And I get to explore all the land free without somebody taxing me for it.

Watch out young Democrats..don’t be fooled. I was fooled for a long time..but Woke Up! Thank goodness!