Multiple times in the past, Guilford County voters have told the county commissioners that they don’t want a quarter-cent sales tax hike.

The county’s voters sent that exact same message in the Tuesday, May 17 election when nearly 55 percent of those voters said, once again, keep the sales tax rate where it is.

So, the county commissioners have finally heard that message and –

–and ignored it once again.

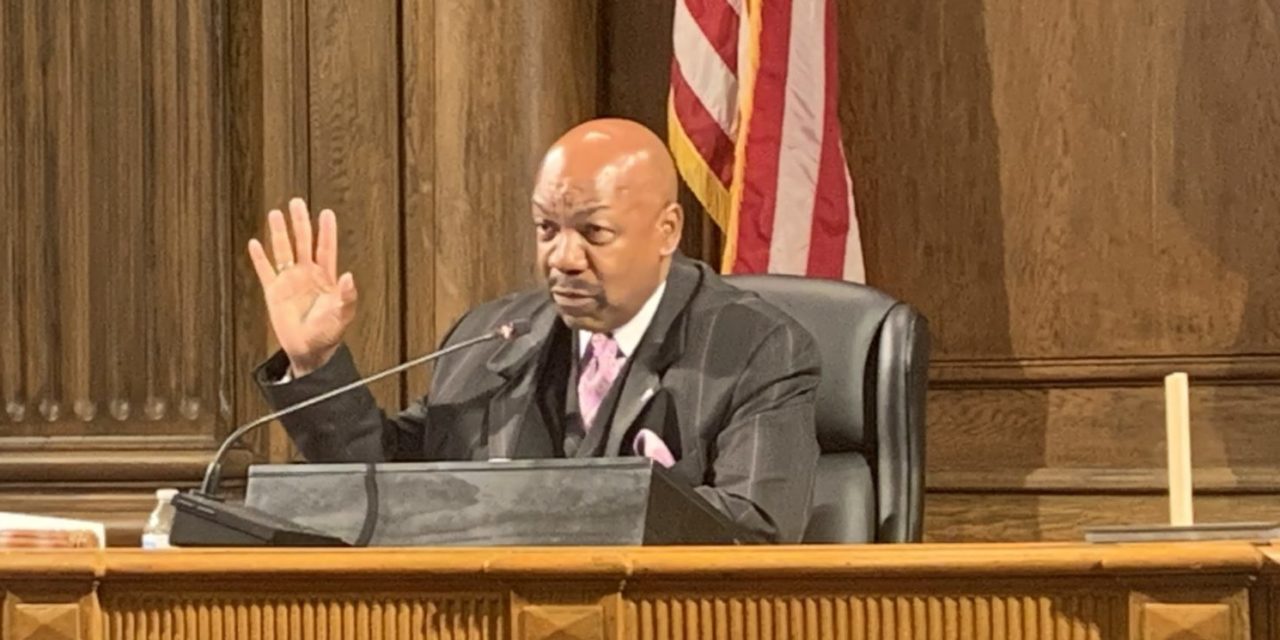

On Thursday, May 19 – just two short days after the quarter-cent sales tax hike went down in flames once again – Chairman of the Guilford County Board of Commissioners Skip Alston announced that he was trying to get the sales tax increase on the ballot in November for the general election this year.

Alston said at the May 19 commissioners meeting that the reason people keep voting the tax increase down is that they don’t understand how beneficial it would be to property owners and that the money would be used for school needs.

Despite what Alston says the money from the sales tax would not go to the schools. Sales tax revenue goes into the general fund along with property tax revenue and other sources of revenue. Money for the schools comes from the general fund, but dollars can’t be traced back to their source.

“The quarter-cent sales tax didn’t pass – that’s a loss to our property owners,” Alston said.

He added that it only makes sense that county residents should want to “share the tax burden with everyone who comes into the county,”

“That will take some responsibility off of our property owners,” Alston said.

According to Alston, he has been pushing state legislators to make a long-proposed change in state law that would allow language on the ballot that explains how the additional revenue will be used. Right now, that language is not allowed. He and some other county and school leaders would like a statement on the ballot that explains the money would be used for school needs.

“And, if we can get that done,” Alston said. “I think that people will recognize that it goes to schools and I think it will pass. If we can get that language on the ballot before November, we should look at it again for a November ballot.”

Alston also noted that this year the county commissioners pledged to drop the property tax rate if voters approved the sales tax increase. He said he would be prepared to make that same promise going into the November election.

Republican County Commissioner James Upchurch could only smile as Alston made his case. Upchurch predicted before the election that, if the sales tax hike failed, the Democratic commissioners would put it right back on the ballot.

“I want credit for that prediction,” Upchurch said after the meeting.

Upchurch also said before the election that the school bond would be right back on the ballot too if that failed. But that $1.7 billion ballot initiative passed so we will never know.

They never give up, do they? It’s strange that we never get to vote on a REDUCTION in taxes though, isn’t it?

This is simple. Even Skippy knows he can’t keep his word on not raising property tax rates without some other funding source for what is now going to be nearly $3 Billion ($300 MIllion, plus $1.3 Billion, plus interest) for you to pay the piper for the irresponsible actions of your school board and GCS Administrators. Something has to give: Those who don’t pay property tax don’t get a say, or pay your share and vote with the rest of us. Neal Boortz fair tax plan is the only sensible option nowadays.

With the current jump in prices that President Biden has brought us sales tax revenue will be hitting an all time high. Why not just take more out of folks pockets. After all gas will be in the $6 a gallon range, hamburger around $12 a pound. Heck even lowly old chicken wings are on their way to $15 a pound. Why not add some more sales tax on the backs of the shulbs that are or have been working for a living.

Groceries just shouldn’t be taxed. It’s regressive, it hurts everyone, and it hurts young working families the most. It’s unfair in another way too. People who buy their food with Food Stamps (SNAP/EBT) are exempt from paying the Food Tax, but people struggling to pay their own way are taxed.

It’s one of the most iniquitous taxes imaginable, and we’ve been paying it since 1961, when “Food Tax Terry” Sanford (D) imposed sales tax on food “as a temporary measure”.

Guilford County people/voters what do you have to lose?Vote all Republicans in on commissioners board!!!! The last time we had Republicans in charge we had no real estate tax increase for 8 years.You see what we have to lose when we have Democrats in charge,they look under every rock and any other hiding place to increase our taxes .So vote out Skip and crew and let’s get the Republicans in !!!!! HELP.

Yea and see how well that turned out? Decades of deferred maintenance in schools so our kids are drinking out of lead pipes and breathing asbestos. Republicans have no good solutions to offer so sit down until you do.

you do realize that Republicans have only been in the majority in Guilford County 10, maybe 12 years out of the last 40? But you blame them for “decades” of deferred maintenance? Seems a bit of revisionist partisan talking points.

Give credit where it is due. That was the ultra liberal School Board, they just kept calling the County Board of Commissioners for more milk money they spent on useless pork instead.

And just what have the Dems done since they have been in charge? Bond money unspent, insurance money from schools destroyed by tornado that has never been spent. Do tell how much they care about our children.

Ha! The day I trust Skippy with ANY money will be a cold day in hell.

If they are putting out such enormous school bonds – they’re going to need revenue just to service the debt interest! They’ll steal it one way or the other. I see moving out of this county in the not-too-distant future!

It’s as if the democrats on the commission feel time is of the essence to move ahead with tax increases. But given the political makeup of Guilford County I’m not sure a half dozen elections could turn the tide to fiscal responsibility. I had to laugh at commissioner Alstons mention of the burden of property owners and relief in the form of a tax increase. Maybe the time has come at least for relief for retired homeowners of limited income. And I’m not one, just saying this will hit them hard next year.

Skip will be making sure people get to the polls to vote this in November. The monkey pox will be in full force so we all have to mail in or drop off our ballots.

I wonder why they are having issues finding a county attorney ? Maybe because our current chairperson is duplicitous and misleading to constituents at best. What a shame folks keep voting for this never ending tax raising frivolous regime.

The large increase of county spending in the coming years will result in reduced economic activity by the general public. I doubt any of the “experts” have taken this into consideration or even care about it.

DTF has it right. Skip will be making sure his voter gets to the polls. He will be assisted by loads of dark money that will be used to try and get a congress woman and a US senator elected. Just as they do every general election, the dark money will be used in a massive get out the vote effort. This process is the same effort that keeps he and the liberals in charge and Guilford being irrelevant on the state stage because we are out of touch with the rest of the state and how it votes. The real problem is those who vote as told are promised everything but end up with nothing but they keep on doing it. Those voters need to ask themselves the question Ronald Reagan asked and give themselves a truthful answer. “ARE YOU BETTER OFF TODAY THAN YOU WERE BEFORE?”

Correct Mayor Barnes. The east side of Greensboro has been voting the same people in for decades. I do not mean the same type of politician, I literally mean the SAME people. Guess what? It is still a s%&$hole over there. I say that as someone who grew up on that side of town. The crime rate is still the highest. No grocery stores. Property values lower. What has changed east side? Do you get any more handouts? Are your living conditions or quality of life better? The definition of insanity is doing the same thing and expecting different results. So when you get your ride to the the voting stations think about the fact that nothing has changed when you check the same old box.

Can we see that Skip takes a hike?