In a way, it’s a riddle: When is a 3-cent property tax decrease really a 10-cent tax increase?

The answer: During a countywide property revaluation year in which property values have shot through the roof.

At the Guilford County Board of Commissioners meeting on Thursday, April 7, the three Republicans voted no to a resolution promising that the Board of Commissioners would lower the county’s property tax rate in the coming budget if county voters pass a quarter-cent increase in the county’s sales tax in the election next month.

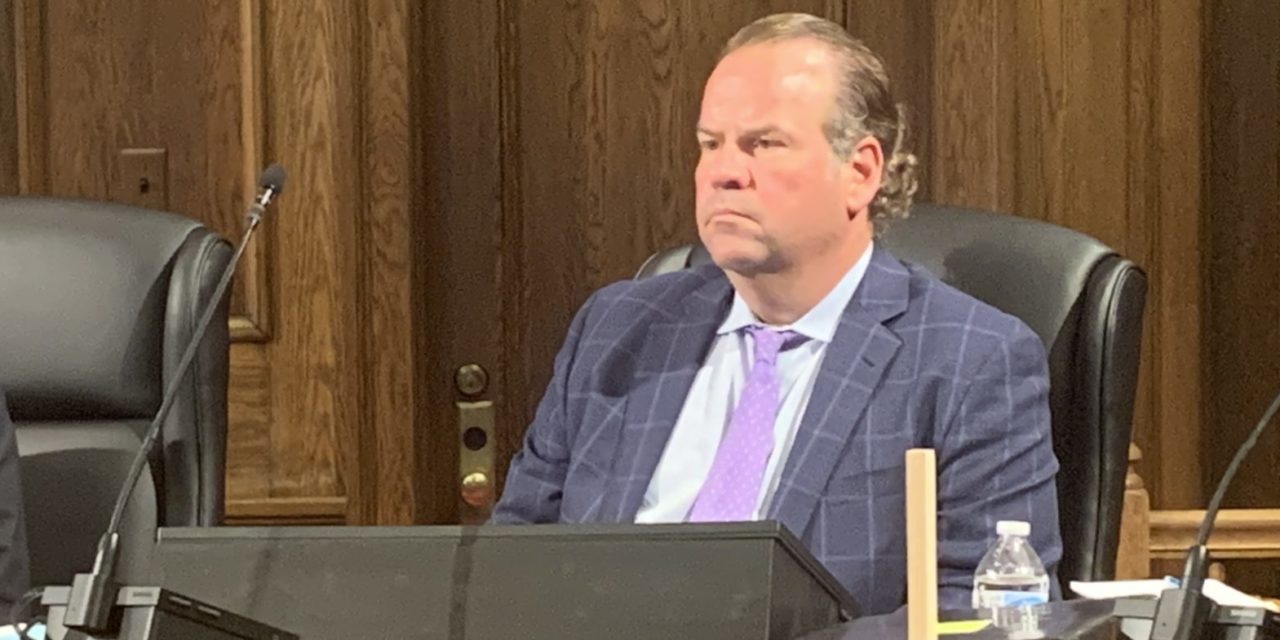

At the meeting, Republican Commissioners Alan Perdue and Justin Conrad said they wouldn’t vote for the proposed conditional tax “cut” because they didn’t want to support a large tax increase – which is what both men said the “cut” really was.

The third Republican on the nine-member board – Commissioner James Upchurch – was participating by phone and also voted no. Upchurch had already made it clear before the April 7 commissioners’ meeting that he also thinks the plan is really just an attempt to trick voters into thinking they’re getting a tax decrease when in reality they are not.

The commitment by the Board of Commissioners that the six Democratic commissioners passed at the meeting, was to reduce Guilford County’s property tax rate by an amount roughly equivalent to the amount that a sales tax hike would bring in. The sales tax increase, if approved by voters, is expected to bring in about $18 million to $20 million in additional revenue each year, which means that the property tax rate could come down about 3 cents – and the county would pull in that same amount of lost revenue from new sales tax proceeds.

(Since the sales tax hike would take some time to implement, it likely wouldn’t bring in the full $18 million to $20 million during the first fiscal year that it’s in effect. The county’s fiscal year starts on July 1 but an approved sales tax would not go into effect until later in the year.)

Perdue, who had phoned in remotely to the meeting in order to participate, said, “I support the sales tax, but I don’t support raising taxes during a revaluation year so I won’t be supporting this.”

Alston asked for clarification. He said the motion before the board did not “call for, or support, a raise in taxes.”

“I think it should be revenue-neutral,” Perdue said of the coming budget.

A revenue-neutral budget would lower the property tax rate by an amount sufficient to keep property tax revenue at the same level as the previous budget.

Perdue’s phone connection cut out at that point, but Conrad was happy to jump in and explain Perdue’s point.

“I believe he was trying to say that he would like to see a revenue-neutral budget without a tax increase,” Conrad said.

Conrad added that the commissioners can “parse words,” but he pointed out that, in the end, even if the tax rate stays the same or comes down a few cents, county taxpayers will still be paying a lot more in property taxes this year since property values have shot up due to the 2022 revaluation.

“To me, it should be part of a more global conversation,” Conrad said of the small rate decrease that would mean people would be paying much more in property taxes.

Conrad also pointed out that the current Board of Commissioners cannot legally commit a future Board of Commissioners to action – and he noted that the board could be very different after the 2022 election.

Despite the concerns from the Republicans, the motion passed on a straight party line vote.

Terrific that our homes and property are worth more money!

Appreciation varies but all good news — and that is on YOUR property.

Thank you. This resolution was nothing but a smoke screen to try and make voters forget about skip and earl’s fleecing of the taxpayers money for the black money pit

Democrat SCUMBAG Commissioners!!!!!

Thank you Justin and other 2 conservatives. The citizens need to vote out ALL liberals from the county commissioners. Liberal is another name for democrats now days.

There is no way to work with the spend, spend, spend Democrats. The point that this group could not pass a resolution committing a future board to a prior action speaks volumes. Democrats do not believe that they need to comply with laws, rules or regulations that stymie their goals. Just remember all this in the coming election. Clean house Guilford County. This is your money they are throwing away.

Vote for the sales tax increase or the mask mandate returns.