There was mostly bad financial news presented at the City Council virtual retreat on Thursday, Feb. 11.

Sales tax revenue is $2 million under expected growth, utility tax revenue is down $1.5 million, hotel-motel tax revenue is down $1.1 million and the Coliseum reports a loss in revenue of over $7.5 million.

Property tax revenue, which has been largely unaffected by the coronavirus restrictions, is holding steady.

After all that bad financial news the City Council spent the much of the morning talking about spending more money, putting a bond referendum on the ballot, issuing two-thirds bonds and buying more police cars.

It was as if the first part of the morning didn’t exist. But Greensboro has more in reserves than it appears.

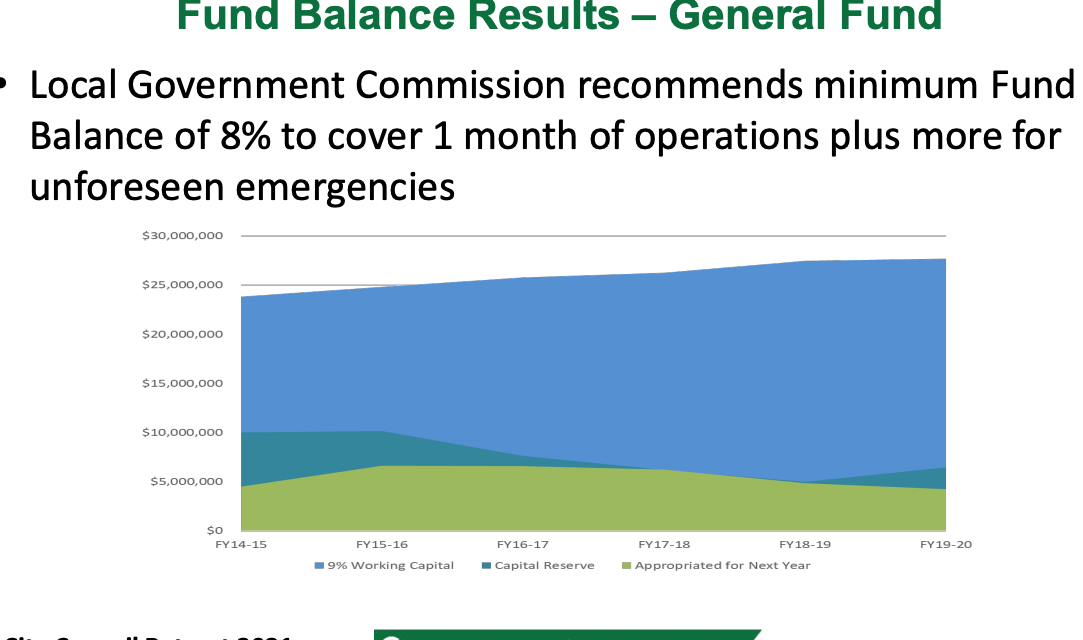

Some of that money was revealed in a slide that showed a much higher amount for the unallocated fund balance, which the city states is 9 percent of the annual budget. The state calls this fund the rainy day fund, or the emergency fund. It is money that is set aside and not allocated to provide cash flow and for an emergency. The North Carolina Local Government Commission recommends that cities keep at least 8 percent of their annual budget in the unallocated fund balance.

The slide revealed that Greensboro has an unallocated fund balance of about 23 percent, using the same accounting some cities and the bond rating agencies use. Greensboro keeps its debt service fund in a separate account, which is money set aside to pay the debt on bonds; other cities and the bond rating agencies include that in the unallocated fund balance. Using this accounting method, Winston-Salem has a 22.7 percent unallocated fund balance and Raleigh 51.7 percent.

Greensboro’s fund balance could be considered higher because it has at least one more fund, called the Capital Reserve Account. When the city has surplus money at the end of the year it goes into the Capital Reserve Account. The Capital Reserve Account was created decades ago by more fiscally conservative councilmembers to hide money from the more profligate councilmembers and is essentially off-budget money.

The original idea was to get $10 million in the account and then spend the excess plus the interest, providing a source of income for the city.

In reality the account has rarely made it to $10 million because the City Council usually finds some reason to spend it before it reaches the $10 million mark.

It is interesting that a stated goal of this City Council is to raise the fund balance to 15 percent when, according to the way some other cities account for their fund balance, the city already has 23 percent in that account.

You people scream we need money. Then each year you say here people you can have $500,000 to do with as you wish. You can build bird houses, buy lollypops are any other stupid thing with it because we will give you another $500,000 next year. You must not know how stupid that is .

Liberal logic: where there is money, we will spend it.

If they convinced Governor Dictator to reopen the economy, maybe sales tax revenue would increase. Maybe more out of towners would come to events and pay hotel taxes and buy tickets for events at the Coliseum again. Maybe people would re enter the labor force and pay utility fees again, instead of asking Roy Boy to get taxpayer relief to pay them instead.

Maybe it’s all just a dream. Too bad.

Following the Council’s logic, if I get laid off from my job, I should buy a new car, take an overseas vacation, and buy lots of stuff I don’t need and can’t pay for.

sounds like the citizens of Greensboro have been overtaxed

’tis easier to spend other people’s money!” Look into the CAFR1, which shows where ALL the money is hidden. They use ‘budget’ to confuse us. “It’s the Biggest Game in Town” per Walter Burien