Many Guilford County homeowners were stunned when the new 2026 revaluation numbers went live.

Some properties jumped far more than the 40 to 45 percent average increase county officials had previously projected. Some properties spot checked by the Rhino Times included homes that more than doubled in value compared to 2022.

Since those new numbers were posted, county officials say they’ve heard from a lot of concerned residents.

Guilford County Tax Director Ben Chavis and other tax officials are encouraging residents to take a closer look at how their values were calculated by using a new, informative and interesting online tool available through the county’s website.

The county’s main 2026 reappraisal page can be found here:

https://www.guilfordcountync.gov/government/departments-and-agencies/tax-department/2026-reappraisal

Chavis said his department wants the public to use its site as a primary source of information. He added that, if residents can’t find what they need there, they are encouraged to call or email the Tax Department for assistance.

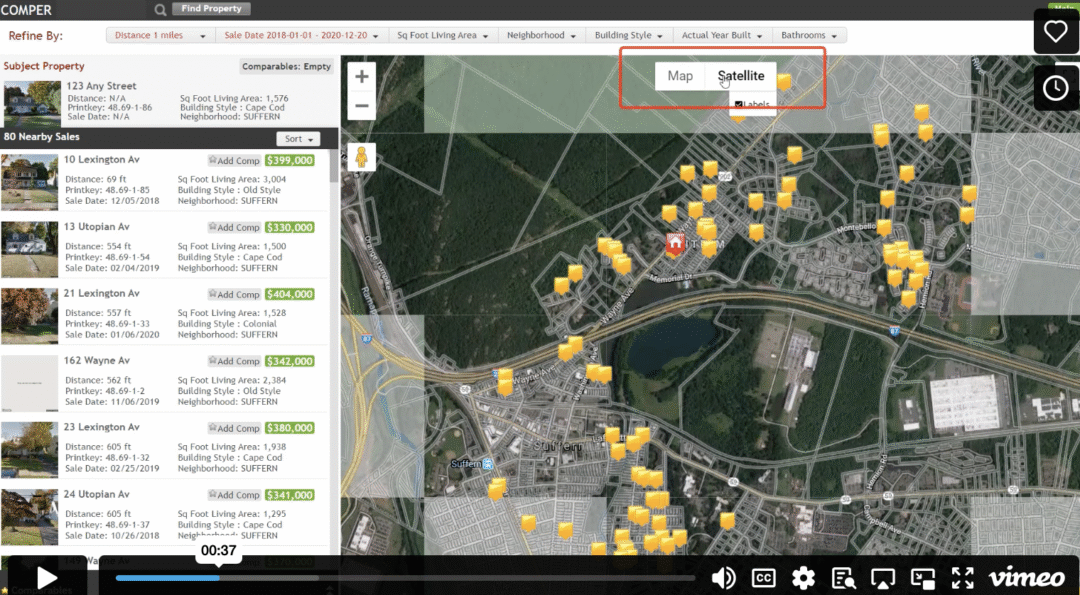

One of the key tools available is called Comper Citizen – a property information and sales-comparison platform designed to make the assessment process more transparent. The direct link to that tool is:

https://nc-guilford-citizen.comper.info/template.aspx

There’s a very short tutorial video, which is surprisingly one of the most calming and relaxing videos of all time. It’s not known if the video tutorial was done in that highly tranquil manner in order to help relax those who are upset about the possibility of much higher property taxes, but, regardless, the training video is very relaxing psychologically and worth watching even if you have no intention of using the tool.

Using Comper Citizen, property owners can:

- View their assessed value

- See the comparable sales used in determining that value

- Explore neighborhood sales trends

- Better understand how the county arrived at its number

The goal, according to county officials, is to help taxpayers see some of the same sales data appraisers reviewed.

Guilford County conducts reappraisals entirely in-house using appraisers familiar with the local market. Tools used in the process include county maps, aerial photography, street-level images, sales analysis, field visits and other data sources.

Reappraisal itself is required under North Carolina General Statutes and is meant to ensure that property values remain equitable and uniform. The county defines reappraisal as an in-depth process of assigning new values to all real property at current market value. If no physical changes are made to a property between reappraisal years, the value shouldn’t change unless market conditions do.

Well, market conditions have certainly changed in recent years in Guilford County.

Commissioner Pat Tillman told the Rhino Times before the board’s Thursday, Feb. 19 meeting that he has heard from many constituents since the values were released. He said he plans to hold one or more individual town halls to communicate with residents who have concerns or questions about the revaluation.

Other commissioners made similar comments from the dais.

It’s also important to understand what the revaluation does – and doesn’t – mean. At least not yet.

A higher assessed value doesn’t automatically translate into a tax increase of that same percentage. What ultimately determines property tax bills is the tax rate that the Board of Commissioners sets for the 2026–2027 fiscal year.

That rate will be adopted in June and will take effect July 1.

Under state law, counties are required to publish a revenue-neutral tax rate after a revaluation. That rate is calculated to bring in the same total property tax revenue as before the revaluation, excluding growth. Commissioners can adopt that rate, go higher or go lower.

For homeowners who believe their value is incorrect, the county also provides an online appeals platform called Appeal Pro. The system allows property owners to submit appeals and supporting documents electronically and communicate securely with appraisal staff.

According to the county, the system is designed to make the appeal process more efficient and transparent.

Information about the appeals process, as well as potential reductions and exemptions – including those available to certain disabled veterans and other qualifying property owners – is available on the Tax Department’s main reappraisal page.

County officials are urging residents to first review their property information and comparables online before filing an appeal. In many cases, officials say, looking at the actual neighborhood sales data can help clarify how a value was determined.

For residents who were shocked by the size of their increase, the Comper Citizen tool may provide either reassurance or ammunition – depending on what the sales data in the comps shows.

Either way, the tax officials say they want taxpayers to start with the information now available online, and to reach out directly to the Tax Department if questions remain.