Greensboro has initiated a pretty sweet deal, Housing Connect GSO, for first time home buyers, and anyone who buys a home in a redevelopment area, if they meet the income requirements.

The deal for first time homebuyers or those who have not owned a home in three years is up to a $10,000 forgivable loan for down payment and closing costs assistance.

It’s even a little sweeter not only is the loan forgivable but it’s at zero percent interest and that’s hard to beat. If the buyers stay in the home for five years the loan is completely forgiven, and they don’t have to pay a penny back. The loan is forgiven at 20 percent per year. Which means if the home buyers lived in the home for one year and then sold it, 20 percent would be forgiven and they would have to pay back 80 percent or $4,000. After two years 40 percent is forgiven and they would be responsible for paying back 60 percent or $3,000 and so on. But since it is a zero interest loan there is no interest to pay back.

The income requirement for a family of four is to be no more than 140 percent of the area’s median income. According to Greensboro Neighborhood Development Director Stan Wilson would be about $72,000. For two people the maximum income is 120 percent of the area’s median income.

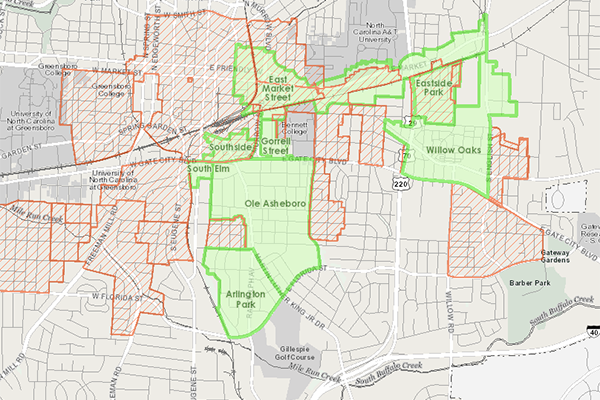

And the deal is better if the home is in a redevelopment area which includes much of east Greensboro. Those buying in a redevelopment area don’t have to be first time homebuyers and are eligible for an a zero percent forgivable loan of $15,000 with the same 20 percent per year forgiven.

The home does have to be the primary residence of the homebuyers and they have to invest a minimum of $500. Also the forgivable loan cannot be for more than 20 percent of the cost of the residence.

Housing Connect GSO is being paid for with a combination of federal funds and 2016 Greensboro Housing Bond Funds.

According to Wilson, the program was initially conceived to help families who lost their homes in the tornado that struck east Greensboro last year, and are now renting. But it is not restricted to tornado victims or to any part of town. There is more money available for those buying in a redevelopment area, but a first time homebuyer in Greensboro that meets the income requirements could buy a home anywhere in Greensboro.

Yeah…look at the area where the “redevelopment zone” is…More like “demilitarized zone”. Looking at https://www.crimemapping.com/map/location/greensboro,%20nc?id= looks like there has been over 250 incidents in this area in the past 90 days including: 2 arsons, over 50 assaults, over 40 burglaries, over 40 drug violations, almost 10 DWI’s, over 10 frauds, almost 15 vehicle thefts, over 20 robberies, over 50 larcenies, over 30 acts of vandalism, almost 30 vehicle break-ins, and almost 10 weapons violations…Not to mention the over 200 sex offenders within a 3 mile radius…Overall sounds like a SUPER SWEET DEAL!!!

you’re smart. I like you post. you’re not living under a rock are you. good boy!